By its decision, the Ukrainian parliament is paying for ammunition for Russian troops waging war against Ukraine. This opinion was expressed by political scientist Vitaliy Kulyk when he got acquainted with the draft laws on tobacco business regulation, which are being generated by the Chairman of the Committee on Finance, Tax and Customs Policy Danylo Hetmantsev.

Thus, on Friday, the committee headed by the deputy recommended adopting the draft law N11090 on amendments to the Tax Code of Ukraine on revision of excise tax rates on tobacco products as a basis. The main purpose of the draft law is to gradually increase the excise tax rates on tobacco products until they reach the minimum level set by Council Directive 2011/64/EU and to set the monetary unit for measuring the excise tax rate on tobacco products in euros.

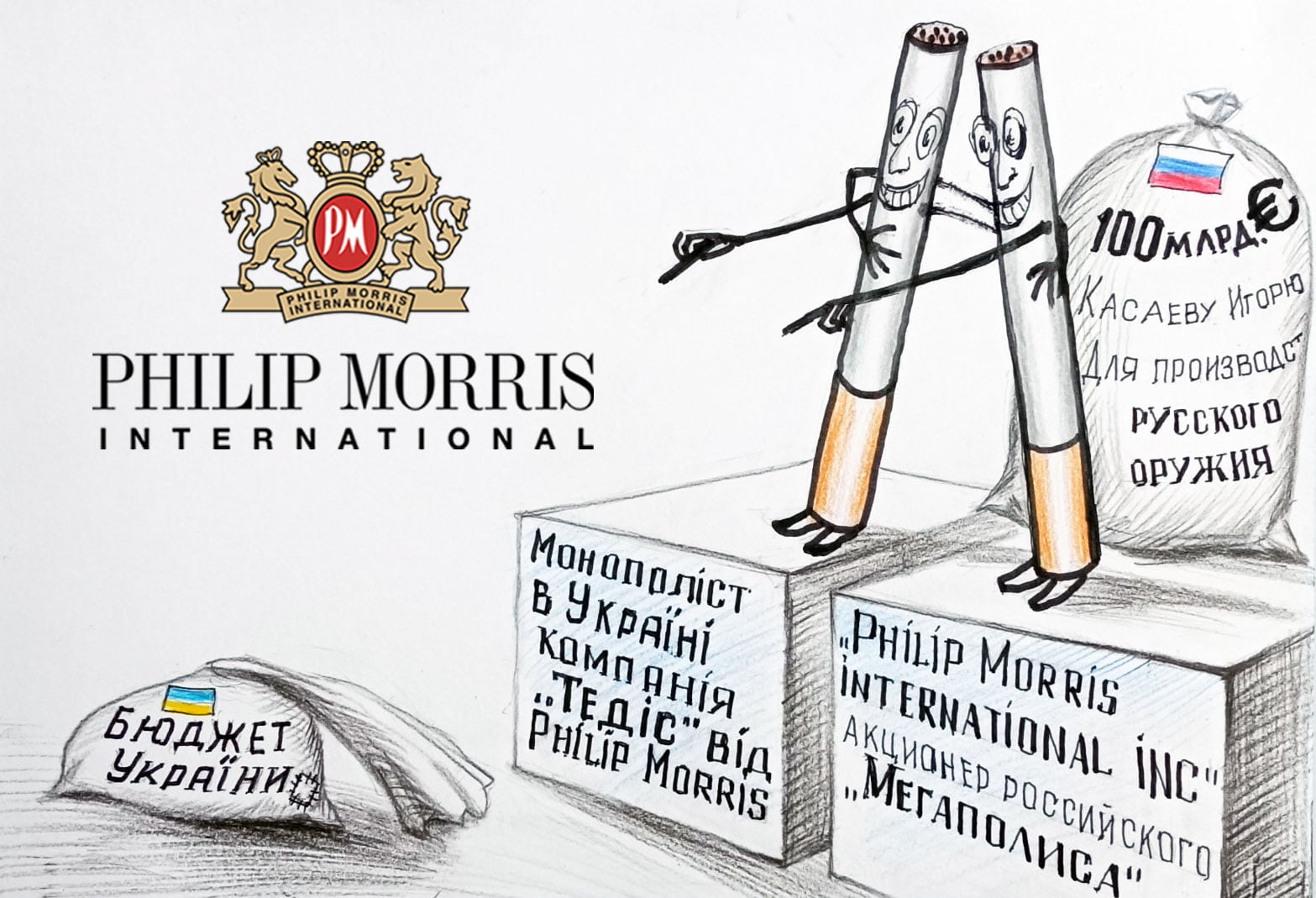

“At the same time, MPs, obviously not without Hetmantsev’s attention, are quietly passing a rule to reduce the excise tax on sticks, apparently in the interest of Philip Morris. The draft law provides for a 30% reduction in excise tax rates on electrically heated tobacco products (EHT), 90% of which are owned by Philip Morris International (IQOS), with a price of UAH 100+. per pack in Ukraine, and in aggregate, Philip Morris holds at least 35% of the total tobacco market in Ukraine.

For those who don’t know yet: Philip Morris is officially recognized in Ukraine as an international sponsor of the war. They pay record taxes to the Russian budget, $8 billion a year for a moment. The same company, by a strange coincidence, has been able to enjoy a record low ad valorem excise rate on higher-priced cigarettes since Yanukovych’s time,” Kulyk writes.

The political scientist also noted that the same people who lobbied for the ad valorem scheme under Yanukovych still control the distribution system in both Russia and Ukraine. They own 90% of the supply of all stacks (fuel-electric heating elements) in Ukraine, which are not manufactured here but imported from Italy.

It is worth noting that Philip Morris International did not leave Russia in 2022 or 2024. They continue to remain in the market and have expanded their presence.

“Philip Morris’ total investment in Russia has now exceeded $2 billion. During the full-scale war in Ukraine, Philip Morris International has invested more than 14 billion in the localization of IQOS tobacco sticks (TVEN) production at the factory in the Leningrad region. The total investment in this plant exceeds $1.1 billion. According to the financial statements, Philip Morris’ revenue in Russia in the first year of Russia’s full-scale invasion of Ukraine increased by 8% to 140.3 billion. RUB, and net profit to 48.2 billion. RUB, which is 45% more than in 2021. Accordingly, Philip Morris International paid more than $136 million in income tax to the aggressor’s budget.

Their goods are sold in the occupied territories. But above all, Philippe Maurice pays money to the Russian budget. And this money is used to manufacture ammunition, missiles and military equipment that are killing thousands of Ukrainians in this war!

Therefore, there is no justification for the decision of Ukrainian MPs to reduce the excise tax rate on fuel cells.

Experts say that at the exchange rate of UAH 39.66 per euro and with 25% of the market for HTPs in the total tobacco market in Ukraine, this decision of the Verkhovna Rada will ensure that the budget will not receive at least UAH 3 billion in excise tax in 2025, almost UAH 4.5 billion in 2026, and UAH 6.9 billion in 2027. However, given the exchange rate fluctuations and the significant growth of the fuel cell market, the amount of lost revenues will increase by at least %-9%,” the political analyst said.

Vitaliy Kulyk emphasized: “Every stack that we buy in Ukraine indirectly means a cartridge that the Russian occupier will use to shoot Ukrainians. This is a business on our blood!”